Jupiter Bay & Unit-Owner Insurance

Although not specifically required by Statute, all Condominium Homeowners should have an H06 Insurance Policy covering the contents of their unit.

Although not specifically required by Statute, all Condominium Homeowners should have an H06 Insurance Policy covering the contents of their unit.

Florida's Skyrocketing Insurance Rates

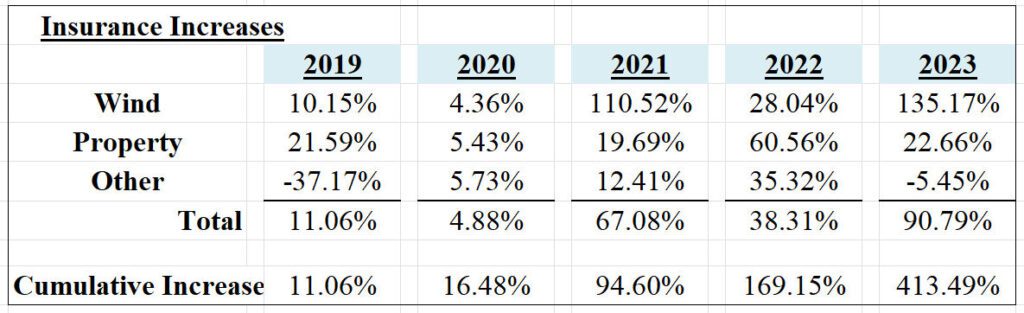

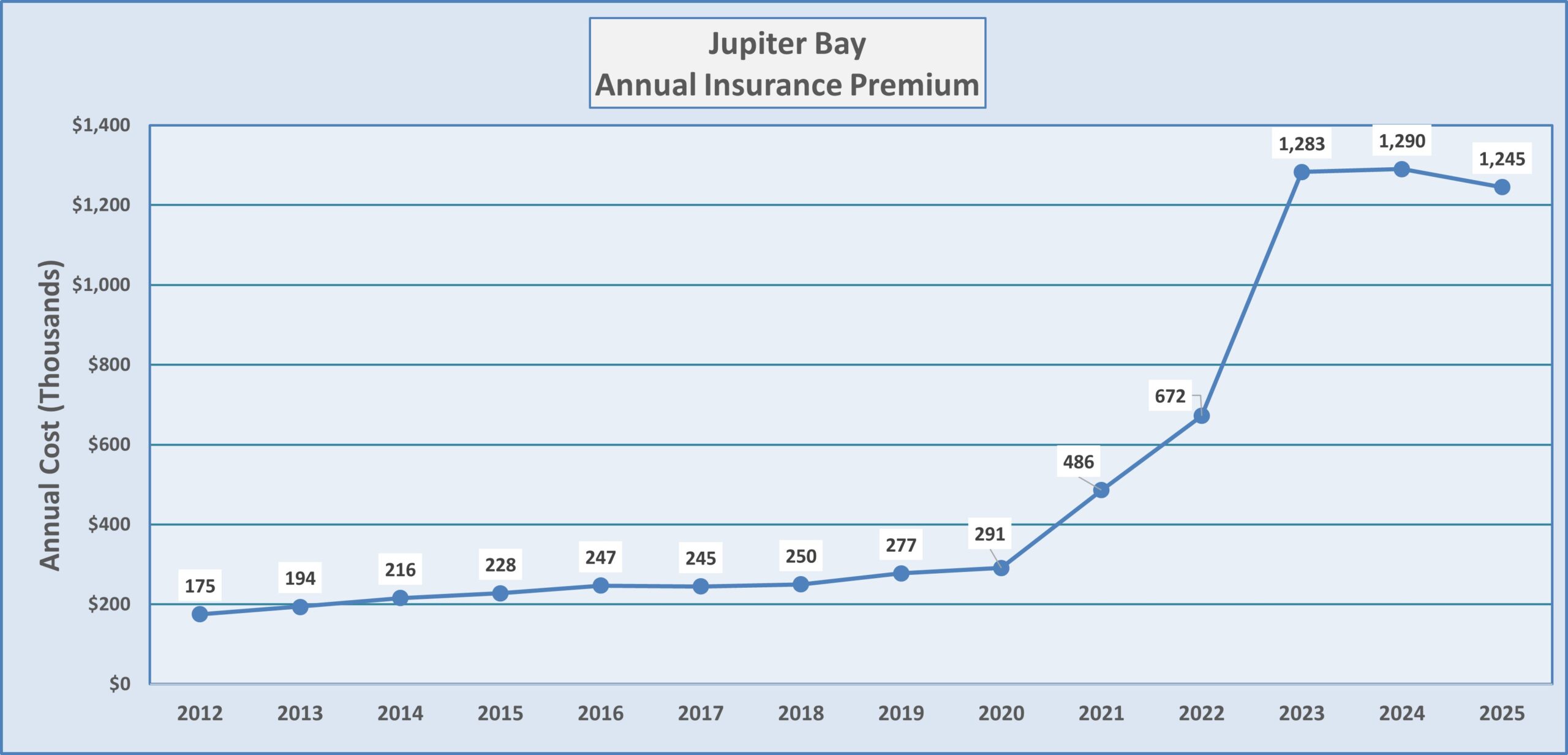

Over the 2019-2023 five-year period Florida's insurance rates, particularly wind insurance, have quadrupled. The problem is due to insufficient fund balances to address possible future insurable events (e.g., hurricanes.) Many insurance companies have left Florida, and those who are staying are refusing to cover certain properties. Florida's legislature has been addressing the problem (see Senate Bill 2D on the News Page of this website) but so far, their effort has yielded few beneficial results to homeowners.

Jupiter Bay has been able to obtain private wind insurance at lower rates for many years, most recently from Frontline Insurance Company. However, starting in 2023 Frontline has refused to insure all but the four East buildings, requiring us to use Citizens wind insurance for the remainder of our property (West buildings, Villas and common area buildings and structures). Citizens is Florida government's insurer of last resort.

This switch to Citizens plus higher secondary insurance market (reinsurance) rates, have resulted in unprecedented increases and additional special assessments. These are required even after the Association included 2022 special assessment amounts in the 2023 budget.

The following chart illustrates the huge insurance premium increases that Jupiter Bay has experienced over the past five years:

Jupiter Bay Insurance Cost

The following chart shows Jupiter Bay's total cost of insurance for the years 2012 through 2025:

Insurance Specifications Worksheet

Prior to meeting with the insurance agent, association management may wish to perform an insurance audit. The auditing process involves examining and analyzing the assets and property that need to be covered by the insurance policy.

In Jupiter Bay's case, our common area property assets include: 14 condo buildings, two swimming pools, 2 pool cabanas, a spa, spa & pool filter equipment & heaters, 2 tennis courts, 2 pump houses, pool shade structures, recycle bin enclosures, parking lot & street lighting, signs, flag pool, pedestrian bridge, BBQ grills, emergency generator/fuel tank, and fences & walls.

The following worksheet, provided by Gray Systems, Inc., provides an example of a worksheet for itemizing what needs to be covered by insurance and for guiding the analyzing of association's needs:

| Please click on the following link: | Insurance Specifications Worksheet. |

It is the responsibility of the board of directors to protect the common elements by assuring appropriate insurance coverage. Failure to provide adequate insurance is one of the liability coverage exclusions.

Hurricane Damage Assessment

Florida's hurricane season runs from June 1st until November 30th. After a hurricane it's important to survey your condominium unit and access and document any damage. The following form will facilitate this process.

| Click here to download Hurricane Unit Damage Survey |

Major Florida Insurance Companies

It generally pays to contact a local agent who will shop for the best insurance policy for your needs. According to the Palm Beach Post, the top 12 Florida property insurers are:

| Company | Weiss Rating | Demotech Rating | # Policies | # Complaints |

| Universal Property & Casualty Insurance Co. | D | A | 636,517 | 1,483 |

| Citizens Property Insurance Corp. | A+ | NR | 438,046 | 1,101 |

| State Farm Florida Insurance Co. | B | NR | 402,681 | 352 |

| Security First Insurance Co. | B- | A | 342,612 | 866 |

| American Integrity Insurance Co. Of Florida | C+ | A | 281,839 | 706 |

| FedNat Insurance Co. | C | A | 240,337 | 592 |

| American Bankers Insurance Co. Of Florida | B | NR | 239,830 | 52 |

| Heritage Property & Casualty Insurance Co. | C+ | A | 231,641 | 526 |

| St. Johns Insurance Co. | C- | A | 183,731 | 225 |

| ASI Preferred Insurance Corp. | B | A | 164,993 | 103 |

| United Property & Casualty Insurance Co. | B- | A | 153,326 | 562 |

| Tower Hill Prime Insurance Co. | D | A | 140,944 | 222 |

Cost of Florida Insurance 2025

Forbes published the following average home insurance rates for the top 2025 Florida insurers:

| Company | $200,000 Coverage | $350,000 Coverage | $500,000 Coverage | $750,000 Coverage |

| Tower Hill Prime Insurance Co. | $739 | $1,127 | $1,477 | $2,042 |

| Progressive Insurance Co. | $750 | $1,035 | $1,438 | $2,150 |

| Universal Insurance | $892 | $1,158 | $1,481 | $2,683 |

| Chubb | $929 | $1,502 | $2,051 | $3,073 |

| State Farm Florida Insurance Co. | $995 | $1,352 | $1,733 | $2,513 |

| Armed Forces Insurance Exchange | $1,024 | $1,805 | $2,584 | $3,885 |

| Allstate | $1,348 | $1,721 | $2,111 | $2,821 |

| Florida Peninsula Insurance | $1,831 | $2,508 | $3,318 | $4,690 |

| Universal Property & Casualty Insurance Co. | $1,865 | $3,430 | --- | --- |

| HCI Hroup | --- | --- | $5,118 | $7,995 |

| Citizens Property Insurance Corp. | $1,951 | $3,184 | $4,450 | $6,692 |

Insurance Claim Form

An owner who has suffered a loss inside their unit should report the loss to their H06 insurance carrier. In addition, they need to complete an Insurance Claim Form (see below) and provide it to the Association Management Office. The Office will forward a copy of this form to the Association's Insurance carrier for their review for any coverage under our master policy.

| Click here to download Insurance Claim Form |

Uniform Mitigation Verification Inspection Form

You can usually achieve significant savings on your H06 insurance policy by contracting a licensed Florida inspector to visit your unit and complete the following form (OIR-B1-1802). Most of our units are protected with fire alarms and sprinklers and have appropriate roof construction qualifying them for discounts. Owners with hurricane shutters will receive additional savings.

| Click here to download FL Uniform Mitigation Verification Inspection Form |

Property Appraisals

Florida statute 718.111(11)(a) requires condominium associations to purchase insurance coverage for their condominium property for its full insurable value based on replacement cost. Replacement cost must be determined at least once every 36 months by an independent insurance appraisal.

Jupiter Bay uses Jolicoeur Appraisal to determine/update its property replacement cost, and the resultant 2024 Property Appraisal is posted on the Association’s website. It shows a 34% increase in insurable value over the prior (2021) appraisal. Here’s a summary of the results:

| Association/Area | 2015 | 2018 | 2021 | 2024 |

| East Buildings | 20,447,400 | 22,507,900 | 27,072,100 | 36,228,300 |

| West Buildings | 23,797,800 | 26,210,400 | 31,221,000 | 41,962,800 |

| Villas | 3,241,600 | 3,648,800 | 4,535,200 | 5,936,000 |

| Common Areas | 1,126,100 | 1,307,000 | 1,527,300 | 2,105,700 |

| Total Appraised Value | 48,612,900 | 53,674,100 | 64,355,600 | 86,232,800 |

| Increase | 10.41% | 19.90% | 33.99% |

Replacement cost is a primary driver of the Association’s insurance costs particularly in determining property insurance premiums. Fortunately, insurance cost reductions for the 2025-2026 insurance period offset much of this property appraisal increase.

Over the past 9 years, Jupiter Bay's property value has increased by 77.4%. On a per unit basis, the current appraised value of East units is $268,358, West units is $218,556, and Villas is $185,500. Common elements, which were appraised at $2,105,700, add $5,865 of value to each unit.

Statutory Insurance Requirements

Per FL Statute 718.111(11), INSURANCE —In order to protect the safety, health, and welfare of the people of the State of Florida and to ensure consistency in the provision of insurance coverage to condominiums and their unit owners, the following applies to every residential condominium in the state, regardless of the date of its declaration of condominium:

- Adequate property insurance, regardless of any requirement in the declaration of condominium for coverage by the association for full insurable value, replacement cost, or similar coverage, must be based on the replacement cost of the property to be insured as determined by an independent insurance appraisal or update of a prior appraisal. The replacement cost must be determined at least once every 36 months.

- Policies may include deductibles as determined by the board based on industry standards and/or available funds.

- An association shall use its best efforts to obtain and maintain adequate property insurance to protect the association, the association property, the common elements, and the condominium property that must be insured by the association pursuant to this subsection.

- Every property insurance policy must provide primary coverage for 1) all portions of the condominium property as originally installed or replacement of like kind and quality, in accordance with the original plans and specifications, and 2) all alterations or additions made to the condominium property or association property.

Condo Association Master Insurance Policies

Condominium Associations typically have eight master insurance policies on the condominium property and staff, including: Property & General Liability, Boiler & Machinery, Island Marine, Wind, General Liability, Crime, Directors & Officers Liability and Umbrella.

The Property and Wind policies cover all of the buildings and other structures within the community, including all parts of the buildings exclusive of the individual units. This includes the exterior walls, doors, catwalks, stairways, elevators, storage rooms, trash rooms, air conditioner compressor areas, recycling areas, and attached buildings or structures housing mechanical or electrical (e.g. master circuit breakers or generators) equipment. It also includes:

- All portions of a unit, except interior surfaces, contributing to the support of the unit building including but not be limited to the outside wall of the unit building and all fixtures on its exterior, boundary walls of units, floor and ceiling slabs exclusive of finished surfaces and plaster, load-bearing columns and load-bearing walls.

- All conduits, ducts, plumbing, wiring and other facilities for the furnishing of utility services contained in the portion of a unit maintained by the Association. This includes electrical wiring up to the unit’s circuit breaker panel, water pipes up to the individual unit shut-off valve, cable TV lines up to the wall outlets in the unit, and sewer and fire sprinkler lines up to the point where they enter the unit.

- All such facilities contained within a unit that service part or parts of the condominium other than the unit within which contained.

Jupiter Bay's Wind & Property Insurance Cost Allocations

Jupiter Bay is a multicondominium association consisting of 8 individual associations and a shared common area consisting of two pools, recreational areas, sidewalks, parking lots, pump buildings, a lake, etc. Florida statute 718 defines “Multicondominium” as real property containing two or more condominiums, all of which are operated by the same association. Both the FL statutes and Association bylaws segregate common expense for an individual association (bylaw class A expense) and common expense for managing and maintaining areas shared by all 8 associations (bylaw class B expense). Paragraph 718.115(1)(b) of the statute says that “The common expenses of a condominium within a multicondominium are the common expenses directly attributable to the operation of that [specific] condominium.” FL Administrative code 61B-22.002 says that “Multicondominium associations shall maintain separate accounting records for the [master] association and for each condominium operated by the association.”

The Association has 9 insurance policies. Six of these policies apply to the requirements and cost of operating the master association. These include equipment breakdown, island marine (equipment floater), crime & theft, directors & officers’ liability, umbrella, and workers compensation. The other three policies (commercial property & liability, general liability, and wind insurance) have components specific to both the master association and each individual association. The premiums for these policies are based on the assessed value of the associated assets and the cost of insuring these assets based on age, condition, construction quality, current code compliance, etc.

The Association’s wind insurance policy has been with Frontline Insurance since 2017. However, for this insurance period beginning February 15, 2023, Frontline has only agreed to insure the 4 East buildings, requiring the Association to obtain wind insurance from Citizens, Florida’s insurer of last resort, for the remainder of our property – West, Villas, and community common areas. Citizens rates are significantly higher. For this reason, the West buildings and Villas are being burdened with a disproportionate share of wind insurance cost, and all 359 units will pay more for their common expense allocation.

FL Statute 718.111(11)(g)3. says that “A multicondominium association may elect, by a majority vote of the collective members of the condominiums operated by the association, to operate the condominiums as a single condominium for purposes of insurance matters, and that the election to aggregate the treatment of insurance premiums constitutes an amendment to the declaration of all condominiums operated by the association.” The requirement for declaration amendments implies that a 75% approval vote would be required by each association. Jupiter Bay’s membership has never adopted this provision, and obtaining the necessary votes for approval would be difficult. Consequently, we are required to separately calculate and charge the costs for property and wind insurance to the specific association/building.

Unit Owners' Need for Insurance

All unit owners are encouraged to obtain a home owner insurance policy covering all personal property within the unit and limited common elements. This will protect the owner from property damage to their unit, liability claims against the unit owner, and Association property loss assessments. The Association’s insurance policy covers damage to air conditioner compressors located on common Association property. All Association buildings are in FEMA flood zone B, requiring no flood insurance.

Unit Owner Insurance Statutes

Following are the specific statutes that address requirements for unit owner insurance policies and unit owner responsibilities:

- a. FL Statute §627.714 — “Coverage under a unit owner’s residential property policy must include at least $2,000 in property loss assessment coverage for all assessments made as a result of the same direct loss to the property, regardless of the number of assessments”.

- b. FL Statute §718.111(11)(g)2 — “Unit owners are responsible for the cost of reconstruction of any portions of the condominium property for which the unit owner is required to carry property insurance, and any such reconstruction work undertaken by the association is chargeable to the unit owner and enforceable as an assessment”.

- c. FL Statute §718.111(11)(j)1 — “A unit owner is responsible for the costs of repair or replacement of any portion of the condominium property not paid by insurance proceeds if such damage is caused by intentional conduct, negligence, or failure to comply with the terms of the declaration or the rules of the association by a unit owner, the members of his or her family, unit occupants, tenants, guests, or invitees, without compromise of the subrogation rights of the insurer”.

- d. FL Statute §718.111(11)(j)2 — “The provisions of subparagraph 1 (see “c” above) regarding the financial responsibility of a unit owner for the costs of repairing or replacing other portions of the condominium property also apply to the costs of repair or replacement of personal property of other unit owners or the association, as well as other property, whether real or personal, which the unit owners are required to insure”.

- e. Jupiter Bay’s Declaration of Condominium paragraph 9.1 — “Each individual unit owner shall be responsible for the purchasing of liability insurance for accidents occurring in his or her own unit”.

Homeowner's H06 Policy Defined

An H06 Policy is an insurance policy crafted specially for condominium unit owners that bridges the gap between the insurance provided by the Association and each unit owner’s insurance needs. It covers all personal property within the unit or limited common elements excluded from the Association's policies. H06 Policies encompass the following five major areas: Dwelling Coverage, Personal Property, Loss of Use, Personal Liability and Medical Payments.

1. Dwelling Coverage (Coverage A) generally insures the interior walls, drywall, wallpaper, paneling, flooring, carpeting, and built-in cabinets. This covers the part of the building (your unit) that you own. The interior of your unit is your responsibility, and it is important to make sure your real estate investment is protected. Dwelling Coverage usually covers damage resulting from:

- Accidental discharge, leaking or overflow of water from your plumbing lines, fixtures or appliances;

- Fire and lightning;

- Explosions;

- Theft, vandalism and malicious mischief;

- Sudden, accidental damage from smoke;

- Accidental or purposeful discharge of fire sprinklers; or

- Sudden, accidental tearing, cracking, burning or bulging of a hot water heating system.

Dwelling Coverage does not cover damage caused by earthquakes, floods or hurricanes or theft by someone named on your condo policy as an insured party.

2. Personal Property (Coverage C) typically protects your personal belongings against the same list of risks and perils mentioned in Dwelling Coverage above. Your personal property is not covered by the Association's master building policy, and you should protect it. Unlike dwelling coverage, where the building policy might provide some coverage, your personal property is at risk. Personal property includes everything you own in your home. Furniture, TVs, appliances, jewelry, computers, rugs, clothing, books, cookware, etc. Everything that is not attached to your condo is personal property and it should be insured.

3. Loss of Use (Coverage D) - If a loss occurs and your condo is damaged, it may take some time to renovate your condo. During this time, you will probably need somewhere else to live while the work is being done. How will you pay for additional living expenses while your condo is being fixed? Loss of Use coverage will insure you for temporary housing expenses such as an apartment rental. Loss of use coverage will also cover things like furniture, car and boat storage, and even pet kennel expenses.The Loss of Use coverage usually has a limit based on a percentage of the Personal Property limit, often around 40%. For example: if you insure Personal Property for $30,000, your Loss of Use coverage limit would be $12,000 (40% of $30,000).

4. Personal Liability (Coverage E) - One of the most important parts of a condo insurance policy is the Personal Liability Coverage. This will cover you against lawsuits, legal expenses, and medical costs if you are legally responsible for injury or property damage to others. The coverage here is variable, but most insurance professionals recommend $500,000.

5. Medical Payments (Coverage F) - If a person is injured in your condo, and they are not named on your policy, this coverage would pay for some minor medical treatment, such as exams or X-rays. Generally, this coverage is fairly low ($1,000 - $2,000), but provides the insured with means to cover minor medical expenses without filing a claim against the Personal Liability Coverage portion of the HO6.

Although not specifically required by Statute, all Condominium Homeowners should have an H06 Insurance Policy covering the contents of their unit.

Although not specifically required by Statute, all Condominium Homeowners should have an H06 Insurance Policy covering the contents of their unit.