Condominiums in Florida are created pursuant to Florida Statute 718, and they are governed by the Association's Condominium Documents.

Condominiums in Florida are created pursuant to Florida Statute 718, and they are governed by the Association's Condominium Documents.

Specific information is provided below for amendments regarding: Milestone Inspections & Reserve Studies, Association Websites, Estoppel Certificates, Sale Disclosures, and Fire Sprinkler requirements. Recent changes to Emotional Support Animal laws and Assessment Notices & Collections changes are covered on the "News" page of this website.

Owners should be familiar with Florida Statutes and the Association's Governing Documents:

-

Jupiter Bay Docs Jupiter Bay's Declaration & Bylaws.

-

Rules Association's Rules & Regulations.

-

Elections & Voting Board Member elections & voting procedures.

-

Inspections Mandatory structural inspection requirements.

-

Penalties FL Statute compliance & penalties.

-

Emergencies Association emergency powers.

Milestone Inspections & Reserve Studies

This article has moved to the "Inspections" page of this website.

Condominium Documents

- Declaration of Condominium is the master deed that's recorded in the county where the condominium is located and creates the condominium. It defines the portions of the development that individual owners are responsible for and those managed by the Association. It creates the framework for operating/managing the Association and defines the rights, restrictions and responsibilities of each owner in the Association. It provides legal descriptions and identifies units and common expense percentages.

- Articles of Incorporation (corporate charter) bring the Condominium Association (i.e., the corporation) into existence and describe its structure.

- Plot Plan & Survey define what's included in the Association and sets boundaries for condominium units, land and common areas/structures.

- Bylaws define how the Association operates.

- Rules and Regulations are supplemental restrictions authorized by the bylaws and promulgated by the board. They regulate day-to-day use of the condominium units and common areas.

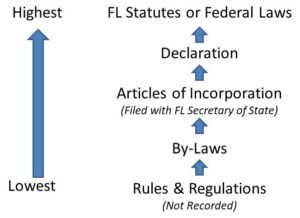

Hierarchy of Documents

Here's the order of document precedence. FL Statutes overrule all other documents unless they specifically say "unless defined in the association's Declaration".

Condominium Statutes Legislative Changes

7/1/25 Legislative ChangesDuring the 2025 Legislative session, the following bills effecting condominiums were approved:

|

7/1/24 Legislative ChangesDuring the 2024 Legislative session, the following bills effecting condominiums were approved:

|

7/1/23 Legislative ChangesDuring the 2023 Legislative session, the following bills effecting condominiums were approved:

|

7/1/22 Legislative ChangesDuring the 2022 Legislative session, the following bills effecting condominiums were approved:

Click here to Obtain Summary of 2022 Changes * See the "Inspections Page" of this website for additional information on Senate Bill 4D. |

7/1/21 Legislative ChangesDuring the 2021 Legislative session, the following bills effecting condominiums were approved:

|

7/1/20 Legislative ChangesDuring the 2020 Legislative session, the following bills effecting condominiums were approved:

|

7/1/19 Legislative ChangesFlorida House Bills 7012 & 7103 introduced changes to Florida's Condominium Statutes related to the following area:

|

7/1/18 Legislative ChangesFlorida House Bill 841 introduced several changes to Florida's Condominium Statute 718 related to the following areas:

|

7/1/17 Legislative ChangesFlorida House Bills 398, 1237 & 6027 introduced several changes to Florida's Condominium Statute 718 related to the following areas:

|

Estoppel Certificate Requirements

Per Florida Statute 718.116(8)

Estoppel Issuance: Within 10 business days after receiving a written or electronic request from a unit owner or the unit owner’s designee, or a unit mortgagee or the unit mortgagee’s designee, the association shall issue the estoppel certificate. Each association shall designate on its website a person or entity with a street or e-mail address for receipt of a request for an estoppel certificate issued pursuant to this section. The estoppel certificate must be provided by hand delivery, regular mail, or e-mail to the requestor on the date of issuance of the estoppel certificate.

If an association receives a request for an estoppel certificate and fails to deliver the certificate within 10 business days, a fee may not be charged for the preparation and delivery of that estoppel certificate.

Issuing Agent: An estoppel certificate may be completed by any board member, authorized agent, or authorized representative of the association, including any authorized agent, authorized representative, or employee of a management company authorized to complete this form on behalf of the board or association.

Estoppel Form: A sample Estoppel Certificate can be downloaded here or on the "Forms" page of this website. The estoppel certificate must contain all the information requested in this form and must be substantially in this form's format. The association, at its option, may include additional information in the estoppel certificate. Click here to obtain the sample Estoppel Form: Estopple Form.

Effective Date: An estoppel certificate that is hand delivered or sent by electronic means has a 30-day effective period. An estoppel certificate that is sent by regular mail has a 35-day effective period. If additional information or a mistake related to the estoppel certificate becomes known to the association within the effective period, an amended estoppel certificate may be delivered and becomes effective if a sale or refinancing of the unit has not been completed during the effective period. A fee may not be charged for an amended estoppel certificate. An amended estoppel certificate must be delivered on the date of issuance, and a new 30-day or 35-day effective period begins on such a date.

Estoppel Preparation & Delivery Fees: An association or its authorized agent may charge a reasonable fee for the preparation and delivery of an estoppel certificate:

- $250 maximum, if, on the date the certificate is issued, no delinquent amounts are owed to the association for the applicable unit.

- $100 additional, if an estoppel certificate is requested on an expedited basis and delivered within 3 business days after the request.

- $150 maximum additional, if a delinquent amount is owed to the association for the applicable unit.

If estoppel certificates for multiple units owned by the same owner are simultaneously requested from the same association and there are no past due monetary obligations owed to the association, the statement of moneys due for those units may be delivered in one or more estoppel certificates, and, even though the fee for each unit shall be computed as set forth in the paragraph above, the total fee that the association may charge for the preparation and delivery of the estoppel certificates may not exceed, in the aggregate:

- $750 for 25 or fewer units.

- $1000 for 26 to 50 units.

- $1,500 for 51 to 100 units.

- $2,500 for more than 100 units.

Fees shall be adjusted every 5 years in an amount equal to the total of the annual increases for that 5-year period in the Consumer Price Index for All Urban Consumers, U.S. City Average, All Items. The Department of Business and Professional Regulation shall periodically calculate the fees, rounded to the nearest dollar, and publish the amounts, as adjusted, on its website.

The authority to charge a fee for the preparation and delivery of the estoppel certificate must be established by a written resolution adopted by the board or provided by a written management, bookkeeping, or maintenance contract and is payable upon the preparation of the certificate.

Estoppel Fee Refunds: If the certificate is requested in conjunction with the sale or mortgage of a unit but the closing does not occur and no later than 30 days after the closing date for which the certificate was sought the preparer receives a written request, accompanied by reasonable documentation, that the sale did not occur from a payor that is not the unit owner, the fee shall be refunded to that payor within 30 days after receipt of the request. The refund is the obligation of the unit owner, and the association may collect it from that owner in the same manner as an assessment. The right to reimbursement may not be waived or modified by any contract or agreement. The prevailing party in any action brought to enforce a right of reimbursement shall be awarded damages and all applicable attorney fees and costs.

A summary proceeding pursuant to s. 51.011 may be brought to compel compliance with this subsection, and in any such action the prevailing party is entitled to recover reasonable attorney fees.

Florida Statutes (Condos & HOAs)

Chapter 718 – Condominiums (The Condominium Act) – Members own their unit and an undivided share in the common elements.

- Part I – General Provisions

- Part II – Rights & Obligations of Developers

- Part III – Rights & Obligations of Association

- Part IV – Special Types of Condominiums (leasehold estate, conversion & adding phases)

- Part V – Establishes regulation by the Division of FL Condominiums, Timeshares & Mobile Homes

- Parts VI & VII – Addresses developer rights, responsibilities and regulatory oversight in special circumstances.

Chapter 719 – Co-Ops – Association owns all property (everything) and members have an ownership interest (i.e. a lease to use unit/property.

Chapter 720 – Homeowners Associations – Members own their homes and the association owns common property.

Chapter 721 – Timeshares – Members own a portion of their unit (i.e. for a time period less than a full year).

Other Applicable Florida Statutes

You can link to these Statutes via the "Links" page of this website.

|

Chapter 119

|

— Public Records (Open inspection of records at all reasonable times)

|

|

Chapter 120

|

— Administrative Procedure Act (Sets standards for state agencies & their authorities)

|

|

Chapter 399

|

— Elevator Safety

|

|

Chapter 468

|

— Professions & Occupations (Part VIII - Community Association Management)

|

|

Chapter 482

|

— Pest Control

|

|

Chapter 493

|

— Professional Services (Part III - Private Security Services)

|

|

Chapter 509

|

— Regulation of Resort Condominiums (Rented to public more than 3 times per year for periods of less than a month.)

|

|

Chapter 514

|

— Operation & Control of Public Pools (Pool operation requires valid permit from Department, which is renewed annually.)

|

|

Chapter 553.899

|

— Mandatory Structural Inspections (Building code changes requiring condominiums to complete a Structural Integrity Inspection in 2024).

|

|

Chapter 617

|

— Not-for-Profit Corporations

|

|

Chapter 715

|

— Vehicle Towing

|

|

Chapter 760

|

— Fair Housing Act (Covers race, color, religion, gender, national origin, age, handicapped [including AIDS/HIV], or marital/familial status)

|

Applicable Florida Administrative Code

- Chapters 61B-15 through 61B-24 -- Forms/definitions, filings, documents, developer obligations, penalties, resolution guidelines, financial, the Association, conversion & mediation.

- Chapter 61B-45 -- Non-binding arbitration rules.

- Chapter 61B-50 -- Recall arbitration rules.

- Chapter 61E14-4.001 -- CAM Continuing Education Renewal Requirements.

Non-Developer Sale Disclosure

Per FL Statute 718.503(2)(a), Each unit owner who is not a developer must comply with this subsection before the sale of his or her unit. Each prospective purchaser who has entered into a contract for the purchase of a condominium unit is entitled, at the seller’s expense, to a current copy of all of the following:

- The declaration of condominium.

- Articles of incorporation of the association.

- Bylaws and rules of the association.

- An annual financial statement and annual budget of the condominium association.

- A copy of the inspector-prepared summary of the milestone inspection report as described in s. 553.899, if applicable.

- The association’s most recent structural integrity reserve study or a statement that the association has not completed a structural integrity reserve study.

- A copy of the inspection report described in s. 718.301(4)(p) and (q) for a turnover inspection performed on or after July 1, 2023.

- The document entitled “Frequently Asked Questions and Answers” required by s. 718.504.

The prospective purchaser is also entitled to receive from the seller a copy of the FL DBPR's Governance Form summarizing governance of condominium associations.

Time to Smother Florida's Fire Sprinkler Scare

Article from the Palm Beach Post (August 14, 2016)

By: Ryan Poliakoff The Condo Consultant

Over the past month, significant confusion has developed concerning whether low- and mid-rise condominium buildings (those not greater than 75 feet tall) must comply with Florida laws that require high-rise condominiums without certain types of fire safety systems to either retrofit their properties to include these systems, or opt out by a unit-owner vote.

The Florida Fire Prevention Code provides that all high-rise buildings, defined as those greater than 75 feet tall, shall be protected by an approved, supervised automatic fire sprinkler system, to be installed not later than Dec. 31, 2019. There are exceptions for certain buildings, including those that have an approved engineered life safety system (such as a partial sprinkler system along with compartmentalization, smoke detection and control, and other similar systems).

The Condominium Act has, for many years, provided that the members of an association may, by majority vote, opt out of this requirement. The statute (Section 718.112) says that, by “Dec. 31, 2016, a residential condominium association that is not in compliance with the requirements for a fire sprinkler system and has not voted to forgo retrofitting of such a system” must become compliant by the 2019 deadline. That seems simple enough. (Note that in 2019 the FL legislature extended the deadline to January 1, 2024)

The problem is that, at one point, the statute expressly referred to high-rise condominiums, and that language was removed. The Florida Department of Business and Professional Regulation has recently taken the position that the removal of the “high rise” language effectively applied the Fire Prevention Code sprinkler requirements to all condominiums, regardless of height. This has caused a panic among low-rise condominium properties, which had never considered they might be obligated to retrofit their properties. A minority of association attorneys have agreed with the DBPR, and are advising their low-rise clients that they should conduct opt-out votes so they are not subject to the sprinkler requirements.

The Florida Fire Sprinkler Association Inc. and the American Fire Sprinkler Association’s Florida chapter have recently released a statement that strongly disagrees with the DBPR’s interpretation of the law. They point out that no state sprinkler retrofit requirement for mid-and low-rise condominiums exists, anywhere. The only state code requirement, by its own definition, relates exclusively to high-rise properties.

No other state law or statute, including the Condo Act, contains any sprinkler retrofit requirement. The Condo Act simply says that — notwithstanding any code, statute, ordinance, administrative rule or regulation — an association is not obligated to retrofit the common elements with a fire sprinkler system, if the members have voted to forgo that requirement. Importantly, it does not say the converse — that, absent an opt-out vote, a condominium must install a sprinkler system. That requirement is only found in the Fire Prevention Code, and the Fire Prevention Code only applies to high-rise buildings. Further, it makes sense that the high-rise language was removed from the Act. The opt-out provision in the Condo Act can be used not only to opt out of state laws, but also to opt out of local codes and ordinances.

While the state law has no mid- or low-rise sprinkler requirement, it is conceivable that a local code somewhere in Florida does require low-rise buildings to install full sprinkler systems — and if so, the statutory procedure can arguably be used to opt out of that requirement, as well. I am not aware of any such codes, but I do suggest that even low-rise condominiums check with their local fire marshal to ensure that no such requirement exists. Absent that, however, and accepting you can never predict how any individual judge interprets a law, it seems highly unlikely the language of the Condominium Act, by itself, could be interpreted to require low- or mid-rise condominiums to install sprinklers or fire safety systems.

Keep in mind, the position of the FFSA and the AFSA is against the interest of all fire sprinkler installers. Their members could make millions by supporting the DBPR interpretation of the Condominium Act. They are, to their credit, instead stating the most logical conclusion — that you can’t create a legal requirement that doesn’t exist by removing language from a statute that didn’t control the issue in the first place.

Ryan Poliakoff is a co-author of “New Neighborhoods - The Consumer’s Guide to Condominium, Co-Op and HOA Living” and a partner at Backer Aboud Poliakoff & Foelster, LLP.