News Outside Jupiter Bay

Here's some important Florida, Palm Beach County and Jupiter information effecting our community and homeowners. (Please reference the "News" page of this website for information regarding FL condo laws effecting our association.)

Artificial Intelligence (AI) Generated Articles

I submitted the following prompt into the Copilot AI software: "Reasons for and against buying a Florida condominium?" Following is the unedited AI generated response:

Buying a Florida condominium can be a dream come true or a challenging decision, depending on your circumstances and goals. Let's break down some of the pros and cons:

Pros

- Weather: Florida is known for its warm, sunny climate year-round, making it an attractive location for those who enjoy outdoor activities and beach life.

- No State Income Tax: Florida is one of the few states that does not impose a state income tax, which can be a significant financial benefit.

- Amenities: Many condominiums offer amenities such as pools, gyms, tennis courts, and more, providing a luxurious lifestyle.

- Maintenance: Condo living typically includes maintenance services for the exterior, landscaping, and shared spaces, reducing your personal maintenance responsibilities.

- Investment Potential: Florida is a popular vacation destination, and owning a condo can provide rental income when you're not using it.

Cons

- HOA Fees: Condos come with homeowners association (HOA) fees, which can be quite high and add to your monthly expenses.

- Rules and Restrictions: HOAs often have strict rules regarding what you can and cannot do with your property, which may limit your personal freedom.

- Weather Risks: Florida is prone to hurricanes and tropical storms, which can pose risks to property and require additional insurance costs.

- Market Fluctuations: The real estate market in Florida can be volatile, and property values can fluctuate significantly.

- Privacy: Condo living means sharing walls and common areas with neighbors, which may reduce your sense of privacy.

Ultimately, the decision to buy a Florida condominium depends on your personal preferences, financial situation, and lifestyle goals.

Secondly, I submitted the following prompt into the Copilot AI software: "Is Jupiter Bay a good place to buy a condominium?" Following is the unedited AI generated response:

Jupiter Bay in Jupiter, Florida, offers a desirable lifestyle with its proximity to beautiful beaches, parks, and entertainment options. The area is known for its scenic views and convenient access to amenities, making it an attractive location for potential buyers. The condominium market in Jupiter Bay has seen steady growth, with a variety of units available for sale. The financial stability of the Jupiter Bay Condominium Association is also a positive factor, as they have managed their budgets and expenses effectively over the years. If you're considering purchasing a condominium in Jupiter Bay, it could be a great investment. However, it's always a good idea to consult with a local real estate expert to get the most up-to-date information and make an informed decision.

Are You a Member of the Middle Class?

GOBankingrates defines “middle class” as those with an annual household income that is two-thirds to double the median income.

Their key findings based on 2022 data are:

- Mississippi has the lowest household income ($35,323) needed to be middle class.

- Maryland has the highest household income ($65,641) needed to be middle class.

GOBankingrates’ reports that inflation over the past decade has significantly changed the amount of household income required to be a member of the middle class.

- The definition of the middle class has changed the least in Alaska, where the household income needed to be middle class has increased by just 23.53% from 2012 to 2022.

- In Oregon, the household income needed to be middle class has increased by 53.15% from 2012 to 2022 — the biggest increase of any state.

- Florida ranks #13 in this ranking showing a 43.56% 10-year change in middle-class income requirements.

The household income needed to be middle class in a state is based on the cost-of-living in that state. Here’s what constitutes middle class in Florida:

- 2022 FL middle-class income range: $45,278 to $135,834

- 2012 FL middle-class income range: $31,539 to $94,618

With recent skyrocketing increases in housing prices, homeowner insurance, and Association dues, more and more Floridians may not qualify much longer. Also, many members of the upper class may find themselves dropping a level.

Poliakoff Predicts Condo Foreclosures

Expert: Foreclosures ahead as state’s new condo rules kick in*

Expert: Foreclosures ahead as state’s new condo rules kick in*

Dear Readers: This week, I wanted to remind everyone that the December 31, 2024 deadline for condominiums to obtain a Structural Integrity Reserve Study, or SIRS, is fast approaching. For any budget passed on or after December 31, 2024, the reserve funds mandated by this required report cannot be waived.

That is going to amount to a huge sticker shock for many owners who have gotten used to waiving their reserves each year. The SIRS includes all of the traditional big-ticket items, and also adds some items that may not have been covered in previous reserve studies. As a practical matter, this means that the bulk of your reserves will no longer be waivable.

I have seen condominiums where this is predicted to add six or even seven figures a year to the overall budget — a huge increase. This, when combined with the gigantic insurance increases everyone has experienced the last two or three years, means that large numbers of condominium owners across the state are going to have tremendous difficulty affording homes that were affordable just a year or two ago.

Without intervention from the state, many people are going to lose their homes to foreclosure actions as a result. If you live in a condominium, make certain that you pay attention to any planned budgetary increases and ask your board if they have gotten the SIRS yet, or if they have any rough estimates of what the SIRS reserves will add to the budget.

There’s no simple solution here — insurance and SIRS reserves are both statutorily mandated expenditures, so either the budget must go up to accommodate them, or services are going to have to be drastically reduced.

* 4/14/24 Palm Beach Post article.

Busy Hurricane Season Projected

Colorado State University (CSU) meteorologists have released their first official forecast for the 2024 Atlantic hurricane season, and it doesn't look good.

The forecast calls for an "extremely active" season of 23 named storms:

| 2024 Forecast as of April 2024 | ||

| Forecast Parameter | CSU Forecast | 1991-2020 Average |

| Named Storms | 23 | 14.4 |

| Named Storm Days | 115 | 69.4 |

| Hurricanes | 11 | 7.2 |

| Hurricane Days | 45 | 27.0 |

| Major Hurricanes | 5 | 3.2 |

| Major Hurricane Days | 13 | 7.4 |

| Accumulated Cyclone Energy | 210 | 123 |

| ACE West of 60° W | 125 | 73 |

| Net Tropical Cyclone Activity | 220 | 135 |

New Insurance Companies Enter Florida Market

The Florida Office of Insurance Regulation (OIR) announced that eight new insurance companies will enter the state and begin writing homeowners insurance policies. This is part of the state’s effort to stabilize the home property insurance market, which has seen rates skyrocket in recent years.

The newly approved property and casualty insurers include:

- Ovation Home Insurance Exchange

- Manatee Insurance Exchange

- Condo Owners Reciprocal Exchange

- Orange Insurance Exchange

- Orion180 Select Insurance Company

- Orion180 Insurance Company

- Mainsail Insurance Company

- Tailrow Insurance Companies

Regulators are working to shed policies from the state's insurer of last resort, Citizens Home Insurance, amid fears that it may not have enough money in the event of a natural disaster. However, Citizens’ financial strength is improving. Its surplus increased by 17.5% from previous years, posting a net income in 2023 of $746 million compared to a loss of $2.2 billion in 2022.

Despite legislative reforms and additional insurers, home insurance rates in Florida are expected to rise 7% this year, driving the average premium to $11,759. Once all eight companies begin writing insurance policies, the increased competition may begin to stabilize or reduce prices. However, industry experts said the relief that residents are hoping for might not arrive until 2025 at the earliest.

Soaring Association Fees Straining Homeowners

The Pensacola News Journal published a 1/25/24 article on the rising cost of association fees. The article attributes this significant jump to 1) inflation, 2) home insurance premiums and 3) a law stemming from the June 2021 collapse of the Champlain Towers in Surfside, Florida.

1) Inflation increases.

While inflation throughout the U.S. cooled throughout 2023, prices for goods and services are still up, and no sign of relief is in sight.

For associations (HOAs and condos), the price of rising inflation hit from every direction. Maintenance and services increased due to the rising cost of materials and labor. Inflation increased property values and replacement costs impacting insurance and reserve contributions.

A growing population boom that started in July 2021 made Florida the second fastest-growing state in the nation, adding to a general increase in the state’s cost of living and the highest inflation rate in the nation.

Excluding insurance, Jupiter Bay’s 2024 budget is up $257,934 (8.3%) due primarily to maintenance costs (building, common areas, tennis & bocce ball courts, lake & irrigation, fire protection systems, and elevators).

2) Florida’s soaring insurance costs.

Home insurance premiums soared as companies became insolvent or pulled out of the state. The Florida Department of Financial Services has a list of 14 companies that are in liquidation.

There has also been a steady increase in insurance payouts due to climate change: stronger and more frequent storms, tornadoes, hurricanes, and heat waves. This, combined with more people living in Florida is causing huge insurance payouts, impacted by more costly building materials and repair costs. Finally, 79% of the nation’s lawsuits between Florida insurance companies and contractors or policyholders come from the state.

Jupiter Bay’s insurance costs, driven by skyrocketing wind insurance increases, are up 313% in the last 5 years.

3) New Florida law impacting associations.

Florida Senate Bill 4-D, passed on 5/26/22, modifies Florida Condo Statute 718, establishing a statewide structural inspection program, requiring Condominium Associations to conduct Milestone Structural Inspections of their buildings and revises association reserve funding requirements.

This law burdens associations with increased engineering fees for inspection and reserve studies, and it could necessitate significant increases in reserve contributions. Associations are required to complete a Structural Integrity Reserve Study by Dec. 31, 2024, to determine how much money they ae required to retain.

Regardless, Jupiter Bay has reduced its 2024 reserve contributions by $129,487 (18.1%).

Older Air Conditioners May Need to be Replaced

According to a September 17, 2019 article in the Palm Beach Post, Freon, needed by air conditioners installed before 2010, may not be available after January 1, 2020. Freon is the Dupont/Chemours Company brand for the refrigerant R-22. Since it will no longer be manufactured in the US or imported after year-end, Freon supplies will be limited and will eventually run out. This means that air conditions that require additional Freon may need to be replaced with new units that use the newer R-410A refrigerant.

Replacement includes both the compressor outside the unit and the air handler inside the unit. Although retrofitting a current air conditioner to use R-410A is an option, it may be more cost-effective to replace a current air conditioner with a newer, more energy-efficient unit. Another factor to consider in the purchase of a new unit is that the new refrigerant is less efficient than Freon and may require upgrading to a larger unit. For example a 2-ton unit may need to be upgraded to a 2.5 ton unit to obtain equivalent cooling capacity.

Top Beaches in Palm Beach County

According to a January 15th, 2016 article in the Palm Beach Post, we have the top 4 Palm Beach County beaches at our doorstep or a short drive away. They are:

- Coral Cove: This tiny Tequesta beach, which is the northernmost in Palm Beach County, attracts snorkelers to its rocky shore. Bonus: You can walk to the sublime Blowing Rocks Nature Conservancy from there. Location: 1600 S. Beach Road, Tequesta, 561-624-0065, free parking

- Carlin Park: What are you looking for in a beach experience? You’ll likely find it in Jupiter’s megapark, the largest county-maintained beach park, which comes with a side of soft, clean sand. Location: 400 S. State Road A1A, Jupiter, 561-629-8775, free parking

- Juno Beach Park: The Juno Beach Pier is the crown jewel of this stretch of coastline, and it costs only a buck to stroll its 990-foot length. Location: 14775 U.S. 1, Juno Beach, 561-624-0065, free parking

- John D. MacArthur State Park: The county’s only state park, MacArthur is a must-visit attraction for nature lovers in this neck of the mangrove forest. A walk across a 1/3-mile boardwalk leads to an undeveloped, and typically unpopulated, beach. Location: 10900 Jack Nicklaus Drive, North Palm Beach, 561-624-6952, $5 per vehicle ($4 for single-occupant vehicle or motorcycle)

Condo Board Mismanages its Finances

An article published in The Palm Beach Post on 8/3/25 reported on financial management issues at the Halcyon Condominium Association and the consequences of those issues.

Halcyon is a six-story, 104-residence beachfront condominium in Palm Beach with listing prices ranging from approximately $800,000 to more than $3 million. Problems at Halcyon began about a year ago with the seven-member board’s approval, by a 4 to 3 vote of a major air conditioning project. The association’s treasurer voted against the project saying that it exceeded the association’s annual budget and required a vote of the owners.

According to the PBP article, the association failed to account for $15 million in expenditures and undertook the major $2.5 million air conditioning project without owner approval. It is unclear how all the funds were spent, and the association’s records were inadequate to provide full accounting of the expenditures. The HVAC project involved installation of a rooftop fresh air machine, relocating three condensing units from the roofs to ground level, and replacing the light commercial air conditioning units that serve common hallways.

Based on testimony from the town of Palm Beach’s director of Planning, Building, and Zoning, Florida Building Code classifies the HVAC Project as an alteration instead of a repair. Florida statutes and the association’s bylaws require owner approval for material alterations.

A lawsuit was filed against the association by a unit owner who said “All I ever wanted was for them to allow the owners to have a say as our documents require. I do not know what they are afraid of, but if I prevail, they will have to pay my legal fees, which now total more than $200,000. And they have spent just as much.”

Because of the board’s actions, a judge ordered Halcyon to halt the air conditioning project and appointed a receiver to oversee management of The Halcyon condominiums. (A receiver is a neutral third party appointed by a court to take control of a business, property, or assets to manage or preserve assets.) Additionally, the judge ruled there is no urgent need for the work to be done and the association failed to produce any evidence that the air conditioning system needed immediate repair

This article provides another example of a condominium board making major financial decisions impacting unit owners without the owners’ proper involvement and consent. Note that the judge who ruled on this matter felt the board was spending money on air conditioning repairs that didn’t need to be immediately addressed. There are similarities between this association’s air conditioning project and Jupiter Bay’s Concrete Remediation Project.

Florida Asphalt Shingles Could Get Nixed

A December 2024 article in the Palm Beach Post (PBP) quoted Michael Yaworsky, commissioner of the Florida Office of Insurance Regulation, as saying that “It’s probably time to look past asphalt shingles” for Florida roofs. Asphalt shingle roofs do not hold up well in Florida’s extreme heat and hurricanes, and they are not considered ideal in insurance premium calculations.

People in the construction industry report to have seen insurers force homeowners to get new roofs based on the chronological age of their asphalt roof, even if there are no visible signs that the shingles need replacing.

The problem homeowners have in considering a switch from asphalt to Concrete (ceramic) tile or metal is the cost. Concrete is 50% more than asphalt shingles and metal tile is about 65% more.

Florida’s My Safe Florida Home has subsidized thousands of new asphalt shingle roofs, and funding for the program is expected to nearly double. In that program, the state matches, for qualified homeowner participants, every dollar spent with $2 for specific home-hardening projects including roof covering replacements. Resulting upgrades have saved homeowners an average of $1,000 in annual insurance premiums.

According to the PBP article, part of the Insurance Institute for Business & Home Safety’s (IBHS’s) 2026 strategy includes evaluating the relative wind performance across residential and commercial roofs to provide guidance on the best and worst performing roof systems over their lifetime. Their evaluation could impact future insurance rates and homeowner decisions.

Florida Anti Squatter Bill

On 3/27/24, Governor DeSantis signed Florida HB 621 into law that will effectively put an end to squatters’ rights in the state of Florida. The new legislation, set to take effect on 7/1/24, will increase penalties for those who occupy a building without the property owner’s approval and empower law enforcement to immediately remove any unlawful tenants who do not have an authorized lease.

This legislation provides that under certain conditions the owner of the property occupied by a squatter can contact the sheriff and file a complaint under penalty of perjury listing the relevant facts that show eligibility for relief.

The conditions include:

- The individual has unlawfully entered and remains on the property.

- The individual has been directed to leave the property by the owner but has not complied.

If the complaint shows that the owner is eligible for relief and the sheriff can verify ownership of the property, the sheriff must remove and is authorized to arrest the unauthorized occupants. The property owner must pay the sheriff the civil eviction fee plus an hourly rate if a deputy must stand by and keep the peace while the unauthorized person is removed.

The sheriff is not liable to any party for loss, destruction, or damage. The property owner or agent is not liable to any party for loss, destruction, or damage to personal property unless it was wrongfully removed.

Violating HB 621 (2024) can result in strict penalties for those engaged in squatting and related activities:

- False Statements: Making false statements to obtain property rights or falsifying a lease or rental agreement is considered a first-degree misdemeanor under the new Florida law. Individuals who engage in deceptive practices to gain unauthorized access to residential properties can face legal consequences.

- Occupying Residential Dwelling: Squatting with the intent to cause $1,000 or more in damages is classified as a second-degree felony. This provision emphasizes the severity of intentional squatting and aims to protect property owners from substantial harm caused by unauthorized occupants.

- False Advertising of Property or Rental: The bill also addresses false advertising related to residential properties.

Florida's Car Insurance Nightmare

Florida’s Governor Ron DeSantis, in his 4/22/24 DeSantis Daily Newsletter, addressed the national car insurance nightmare faced by Florida drivers. According to DeSantis, “life is becoming more expensive, and the thrill of the open road is costing an arm and a leg.”

Florida's car insurance premiums have surged by 22.5% over the past year, the biggest increase in 47 years. Governor DeSantis attributed the spike to the release of March’s Consumer Price Index. “The No. 1 individual-itemized increase for inflation was auto insurance,” DeSantis said.

Florida has the second most expensive car insurance in the country behind Louisiana, according to Bankrate’s True Cost of Insurance Report. Besides inflation, which has increased the cost of vehicle purchases, parts and repair, other factors driving up insurance costs are:

- Car accidents, which have been on the rise since 2021. One of the factors for that could be the more than seven million illegal aliens who poured into the country. Illegal aliens are almost always driving without a license and car insurance. The cost of the accidents involving them is being absorbed by drivers who play by the rules.

- Vehicle thefts. The country is experiencing a historic numbers of vehicle thefts. The number of cars stolen crossed the one million threshold in the U.S. for the first time in 2022. That $6.6 billion cost of stolen vehicles results in more losses that insurers must pay out.

- More electric vehicles on the road, which are heavier and more expensive besides being loaded with pricy electronics.

This is one more inflationary issue to deal with besides rising grocery bills, gasoline, and housing costs.

PBC Housing & Home Insurance Issues

On May 24, 2023, Politico published an article entitled “In DeSantis’ Sunshine State, life is not all sunny”. According to the article, even with unemployment at 2.6 percent and relatively plentiful jobs, Florida is not without problems or issues for political criticism, including:

- Lack of affordable housing, with nine of the 21 most overpriced housing markets in the country,

- High healthcare costs,

- Rising insurance rates,

- Lax gun carrying laws,

- Abortion restrictions, and

- Book bans.

A spokesperson for DeSantis acknowledged the rising housing costs but said it was a result of the ongoing migration into the state, including from blue strongholds like New York and California. He also contended that part of the blame is due to inflation and federal government policies, including a national eviction moratorium. He added that while DeSantis has been in office, the governor has consistently backed pouring more state money into affordable housing programs.

Insurance costs also have been a constant conundrum in DeSantis’ Florida, a state frequently hit by devastating hurricanes and other natural disasters. Numerous insurance companies have gone insolvent, and the state-created insurer of last resort (Citizens) has swelled in size. Some companies have reduced the number of policyholders, while rate hikes are ubiquitous, and more are coming this year.

Responding to Politico’s report of the state’s skyrocketing insurance rates, Jim Kalec, president of Jupiter Bay, a condominium association in Jupiter on the state’s Atlantic coast, said that the insurance costs to cover 359 units has grown from $285,000 in 2020 to nearly $1.3 million just three years later. “We don’t see any light at the end of the tunnel,” said Kalec.

DeSantis and Republican legislators have tried multiple times in the last two years to deal with insurance, including using billions in taxpayer money to stabilize the market. They also have passed in the last six months two substantial bills to clamp down on insurance companies by restricting lawsuits.

Still, the problems with housing and insurance have opened a potential line of attack from a web of Democratic-leaning organizations seeking to define DeSantis for voters across the country who may not be familiar with his record.

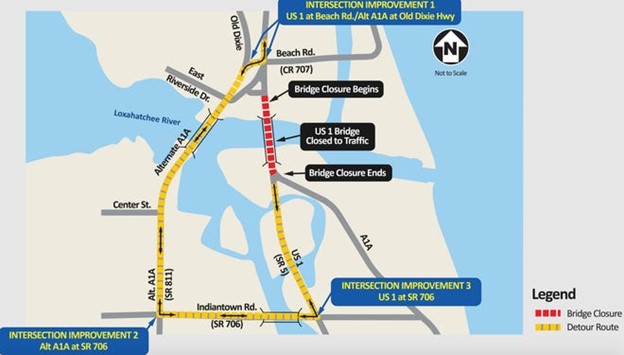

Replacement of Jupiter Bridge on US Hwy 1

The $133 million project to replace Jupiter’s US Highway 1 bridge over the Loxahatchee River and Intracoastal Waterway began on March 13, 2023. FDOT spent 15 months preparing for the closure by improving intersections along the detour route. The bridge closure will last approximately 20 months, or until late 2024, at which point, a new bridge will open to vehicular traffic.

The $133 million project to replace Jupiter’s US Highway 1 bridge over the Loxahatchee River and Intracoastal Waterway began on March 13, 2023. FDOT spent 15 months preparing for the closure by improving intersections along the detour route. The bridge closure will last approximately 20 months, or until late 2024, at which point, a new bridge will open to vehicular traffic.

The new Federal bridge over the Loxahatchee River will be 42 feet tall, which is 7 feet taller than the Indiantown Road bridge, allowing larger boats to pass without needing to open the bridge as often. The new bridge will include an observation deck, which will connect to Jupiter’s Riverwalk. The bridge will consist of two 11-foot travel lanes in each direction, 8-foot sidewalks and 7-foot bike lanes in both directions. Pedestrians will be separated from traffic with permanent concrete barriers. The new bridge will be a twin double-leaf drawbridge, feature a concrete bridge deck to reduce traffic noise, a new tender house and pedestrian overlooks.

During this period traffic heading south on Highway 1 will be required to veer right onto Alternate A1A via an improved intersection, and traffic heading north on US Highway 1 will be detoured onto Indiantown Road and then north onto Alternate A1A. (See following map.) The detour is necessary since the state doesn’t have enough right-of-way space to allow traffic to be directed to one side of the bridge while it improves the other side.

To help assure project completion on schedule, the Florida general contractor, owner by Texas-based Southland Holdings, will receive a $3.5 million bonus if the detour around US 1 ends by July 25, 2024. The company will get an additional $1.5 million if two lanes of traffic in each direction are open by November 2, 2024.

This posting is based on an article by Katherine Kokal published on 10/7/21 in the Palm Beach Post.

Jupiter Bans Overnight Camper Parking Along A1A

According to Jupiter Police Captain Bill Allen, 30 to 40 RVs and camper vans have parked along the 2.5-mile A1A stretch from Marcinski Road to Carlin Park during peak tourist season. The problem is being exacerbated by social media networks that highlight the advantages of parking overnight this close to the beach with shower access. Jupiter historically has not restricted overnight parking along A1A.

Due the the worsening problem, Town Council members approved on September 23, 2021 a law prohibiting overnight camper parking. The ordinance created a $100 fine for anyone parking an RV or camper van along A1A or in beach parking lots between midnight and 5:00 a.m.

Police officers will immediately begin patrolling the area and issuing warnings to violators. Those who ignore the warnings will be issued a ticket for every night that they park illegally.

Florida's New Texting & Driving Law

Texting and driving was already illegal in Florida, but the new law makes texting (including messaging, emailing and other forms of typing on a mobile device) a primary violation, rather than a secondary violation. That means police can stop you solely on suspicion of texting while driving. Next, it more broadly bans any use of a handheld cell phone while operating a motor vehicle in a designated school crossing or school zone or a road work zone.

Hands-free uses remain legal.

The penalties for these noncriminal traffic violations remain the same:

- First Violation – $30 base fine plus court costs and fees.

- Second Violation – A second violation within five years is considered a moving violation carrying a $60 base fine plus court costs and fees.

- Drivers caught texting will also be dinged 3 points against their licenses.

Texting while driving became a primary offense on July 1, 2019. The ban on handheld use in school and work zones can be enforced starting October 1, 2019 with an education period of warnings until January 1, 2020, when fines can be imposed.

Texting at a stoplight or while a vehicle is stationary is not an offense. Police and emergency personnel are exempted as are those receiving navigation, vehicle operation or safety information (traffic, weather, etc.).

Town of Jupiter & Harbourside Resolve Violations

The Town of Jupiter announced in June 2021 that it reached a settlement with Harbourside Place to resolve current and future event violations related to some of the company’s approval terms. Harbourside previously admitted to 20 violations of the Town Code and paid a fine and costs related to these.

The settlement includes the following:

- Harbourside will submit a new master plan, subject to approval by the Jupiter Town Council.

- Up to 18,000 square feet of retail space will be converted to office or restaurant use.

- Jupiter Town Council will have the authority to review and approve an annual event calendar for Harbourside, including up to 10 events that can feature live music.

- Harbourside will be able to request up to 24 community events annually, including the 10 concerts. The events would be approved as part of the annual review, rather than requiring individual permits.

- Resolution of the $1.3 million tax incentives withheld by Jupiter. $300,000 of this will be transferred to Harbourside.