Jupiter Bay's Financial Management requires understanding Florida statutes and administrative codes and general accounting principles.

Jupiter Bay's Financial Management requires understanding Florida statutes and administrative codes and general accounting principles.

This web page, and linked pages, provide the following important financial-related information: |

|

|

|

The following are key to understanding the Association's financials:

-

Budget Process & steps for preparing annual budget.

-

Reserves For repair or replacement of the condominium property.

-

Insurance Condominium insurance requirements.

-

Delinquencies Process for addressing owner fee delinquencies.

-

Contracts Association contract requirements.

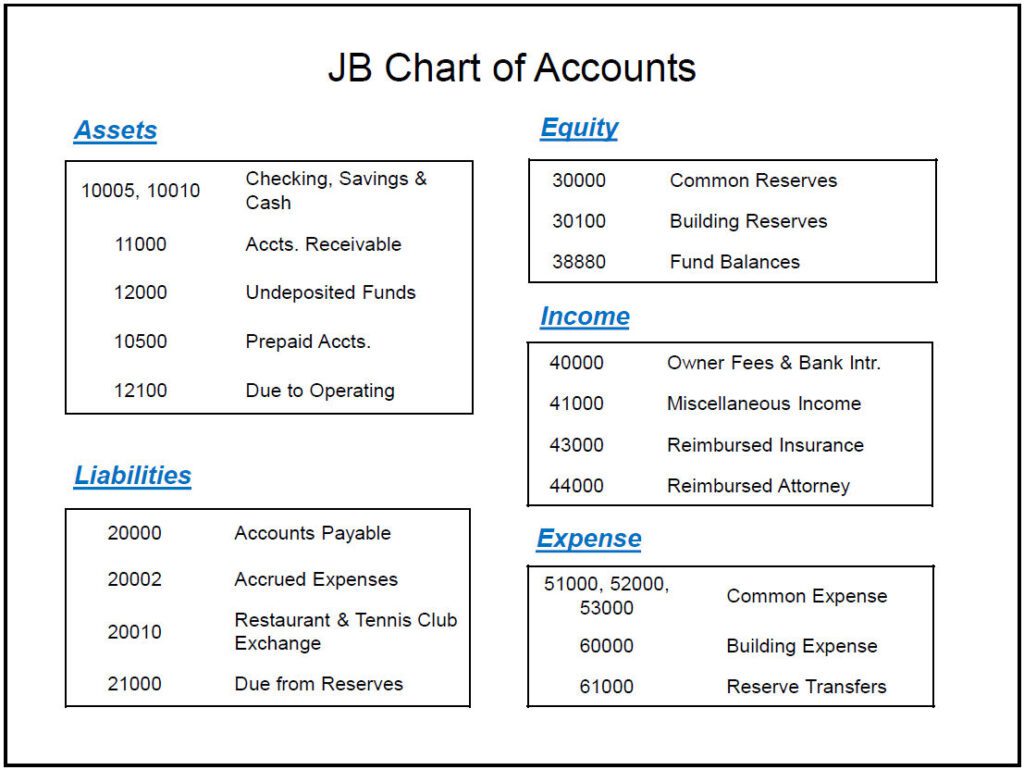

Multicondominium Association Accounting 101

Multicondominium Association accounting requires all income and expense to be posted to the correct association. This is true for both Operating and Reserve accounts.

- Operating Accounts are used for day-to-day operation of the association, whereas

- Master and individual condominium Reserve Accounts are required for capital expenditures and deferred maintenance.

Condominiums use Accrual Accounting, rather than Cash Basis, for tracking and recording income and expenses. This means that income exists when owner invoices are generated, and expenses exist when vendor bills are entered into the accounting software.

At the end of each year an Annual Financial Statement Audit is conducted as required by Florida statutes. The Annual Audit reviews the accounting records and calculates cash balances for the Operating Account(s). Jupiter Bay maintains its own Reserve Account balances on a Reserve Schedule that is maintained monthly and presented to owners each year as a part of the Annual Budget.

Financial Structure

Jupiter Bay is a multicondominium association comprised of eight individual associations:

| East A-D -- 4 Buildings, 135 Units | Villas -- 4 Buildings, 32 Units |

| West A -- 1 Building, 32 Units | West B -- 1 Building, 32 Units |

| West C -- 1 Building, 32 Units | West D -- 1 Building, 32 Units |

| West E -- 1 Building, 32 Units | West F -- 1 Building, 32 Units |

All eight associations share a common Community area containing a lake, waterfall, two swimming pools, two tennis courts, sidewalks, parking lots, roadways, bocce ball court and landscaped grounds.

Separate accounting records, both operating and reserves, are maintained for each of the eight associations.

Jupiter Bay's Common & Building Expenses

Common Expenses (15 Accounts) *

| Annual Condo Fees | Equipment Rental & Supplies | Professional Fees -- Legal, Auditing & Accounting |

| Office Supplies | Lake/Irrigation Maintenance | Pool, Tennis & Bocce Ball Court |

| Board Expense | General (Common) Insurance | Maintenance & Janitorial Supplies |

| Payroll | Landscape Contract/Services | Telephone (Office & Pools) |

| Security Contacts | Common Repair & Maintenance | General (Common) Insurance |

*Each Unit Pays 1/359

Individual Building Expenses

| Building Expense Item | Expense Allocation |

| License/Fire Inspection Fee | By Individual Building |

| Utilities | 1/359 (except Elevator Phones) |

| Property Insurance | By Insured Value |

| Wind Insurance | By Building Premium |

| Fire Sprinklers, Lines & Pumps | By Individual Building |

| Elevator Repair & Maintenance | 10% for each of the 10 Elevators |

| Generator, Alarms & Life Safety | By Individual Building |

| Pest Control | 1/359 (except Hewlett Rodent Control) |

| Trash Removal/Recycle | 1/359 |

| Building Repair & Maintenance | By Individual Building |

Jupiter Bay Expense Splits

Here's detail on the 10 expenses that are split, in differing amounts, to the 8 individual associations:

- License/Fire Inspection Fees – These fees are charged directly to the applicable association/building. They vary because of the different fire protection systems described above.

- Utilities – With the exception of elevator phones, all utility (water, sewerage, electricity, cable TV/Internet, and pool/office phones) expenses are allocated evenly (1/359th) to each unit. Elevator phones are charged to those associations/buildings with elevators.

- Property Insurance – Property insurance premiums are split based on the insured value of the building(s). For the 2/2021 to 2/2022 insurance period, 42.23% of the building property insurance budget was allocated to the East, with 6.80% to the Villas, and 8.15% to each of the 6 West associations/buildings. The remaining 2.07%, which was for common structures insurance, was split evenly among each individual condo unit.

- Wind Insurance – The 4 East buildings are less prone to wind damage and therefore have lower per unit wind insurance costs ($43.37 per month versus $74.37 per month for the Villas and $89.16 per month for the West). Wind insurance premiums are charged to the individual 8 associations based on the premium amount. For the 2/2021 to 2/2022 insurance period, 21.84% of the building wind insurance budget was allocated to the East, with 8.88% to the Villas, and 10.64% to each of the 6 West associations/buildings. The remaining 5.41%, which was for common structures insurance, was split evenly among each individual condo unit.

- Fire Protection – The three 5-story East buildings have fire sprinklers in each unit, the West buildings have fire sprinklers only in the attics, and the Villas have no fire sprinklers. Half of the West pump house equipment is used to deliver high-pressure sprinkler water to the West Buildings and restaurant; whereas, the East has its own fire sprinkler pump house adjacent to the East B building. All buildings have fire extinguishers. Fire protection expenses vary based on equipment testing, maintenance, and replacement costs. Due to its extensive fire protection systems, the East usually pays more for fire protection (25% to 45% of the total fire protection expense).

- Elevator Repair & Maintenance – The monthly elevator service contract charge is split evening among the 10 elevator locations (4 for the East and one for each West building). Charges not covered by the contract are charged to the building requiring the repair.

- East Generator Repair & Maintenance – Only the East has an emergency electric generator and receives all related charges.

- Pest Control – The East and West/Villas have separate rodent control contracts with Hewlett that are directly charged. Costs for the general pest control contract with Global are divided 1/359.

- Trash Removal/Recycle – Expenses are allocated evenly (1/359th) to each unit.

- Building Repair & Maintenance – All building repair and maintenance expenses are charged to the association/building incurring the expense.

Florida statutes require expenses to be properly allocated to the associations incurring the costs.

The Mailbox Rule

There is frequently confusion or misinformation regarding the effective date of a document (legal notice, contract, check, etc.) that is sent via US mail. The actual effective date is consistent and is based on the Mailbox Rule. The rule says that it's always the date mailed (i.e., the postmarked date) as shown in the following examples:

There is frequently confusion or misinformation regarding the effective date of a document (legal notice, contract, check, etc.) that is sent via US mail. The actual effective date is consistent and is based on the Mailbox Rule. The rule says that it's always the date mailed (i.e., the postmarked date) as shown in the following examples:

- Acceptance of a contract is effective when it is mailed.

- The effective date of a Claim of Lien or Foreclosure notice is defined by statute as the date of mailing.

- Florida courts have been clear about when owner assessment payments should be credited (when mailed, not when received).

Financial Reporting

Per Florida Statute 718.111(13): Within 90 days after the end of the fiscal year, or annually on a date provided in the bylaws, the association shall prepare and complete, or contract for the preparation and completion of, a financial report for the preceding fiscal year.

Within 21 days after the final financial report is completed by the association or received from the third party, but not later than 180 days after the end of the fiscal year or other date as provided in the bylaws, the association shall deliver to each unit owner by United States mail or personal delivery at the mailing address, property address, e-mail address, or facsimile number provided to fulfill the association’s notice requirements, a copy of the most recent financial report, or a notice that a copy of the most recent financial report will be, as requested by the owner, mailed, hand delivered, or electronically delivered via the Internet to the unit owner, without charge, within 5 business days after receipt of a written request from the unit owner.

Per Jupiter Bay's Bylaws Paragraph 9.13: Within sixty (60) days following the end of the fiscal year, the Board shall mail, or furnish by personal delivery, to each Unit Owner a complete financial report of actual receipts and expenditures for the previous twelve (12) months. The report shall show the amount of receipts by accounts and receipt classifications and shall show the amount of expenses by accounts and expense clarifications. (This 60-day requirement has rarely been achieved, and the Bylaws need to be changed.)

Monthly Financial Reporting: In 2012 this website's developer, Paul St. Clair, developed a format for monthly financial reporting. Financial Reports conforming to Mr. St. Clair's format have been prepared (typically by the Association's Treasurer) and made available to unit owners every month sinch March 2015. These reports include eight spreadsheets: Treasurers Report, Bank Check Register, Balance Sheet, Reserve Accounts, Budget vs Actual Performance (current month and YTD), P&L by Class, AP Aging Summary, and Past Due Report. Copies of the Reports are posted on the Association's Website.

Jupiter Bay's Financial Policy

| This website's developer, Paul St.Clair, wrote Jupiter Bay's original Financial Policy in 2009. In 2014, Paul was asked by the then current president to update the policy to conform to current statutes, code and procedures. This task was initially completed in February, 2014; and afterwards eight policy drafts were developed, sent to Board members, and reviewed with Jupiter Bay's Treasurer and bookkeeping staff. The updated version, which extensively references the Association's Condominium Documents and Florida statutes, was approved by the Board of Directors at the May 20th 2014 Board Meeting.

The following additional updates to the 2014 version of the Association’s Financial Policy were approved by the Board at a 10/21/15 Board Meeting:

The adjacent column is the Table of Contents from the Association's current Financial Policy. A complete copy is available to unit owners on the Association's Website: Jupiter Bay Condo Association. |

Table of Contents:

|

Budget & Reserves Training

|

Here's a self-study training manual on Budget and Reserve Schedules. The manual provides important information for the Treasurer, other board members and interested owners. It was published by the Department of Business & Professional Regulation, which is a part of the Division of Florida Condominiums, Timeshares, and Mobile Homes. The manual includes training material, with definitions, examples, checklists, and a series of practice exercises. |

Click here to download Self-Study Manual |

Commingling of Funds

Does the Association commingle funds and is it legal? The simple answer to both questions is YES. Commingling is when funds (cash) are mixed between Operating and Reserve investment accounts and among condominiums in a multicondominium community. Florida statutes allow commingling of cash within certain restrictions. However, the Association’s books must accurately reflect at all times the exact funds in the reserve and operating accounts.

Florida Statute 718.111 (14) establishes commingling rules as follows:

- For investment purposes only, reserve funds may be commingled with operating funds of the association.

- Commingled operating and reserve funds shall be accounted for separately, and a commingled account shall not, at any time, be less than the amount identified as reserve funds.

- A multicondominium association is not prohibited from commingling: the operating funds of separate condominiums, the reserve funds of separate condominiums, or all funds for investment purposes only.

In addition, Florida Administrative Code 61B-22.005(2) requires Associations that collect operating and reserve assessments as a single payment to transfer the reserve portion of the payment to a separate account, or accounts, within 30 calendar days from the date the funds were deposited.

Commingling is important in the day-to-day management of the Association’s finances because it allows the Association to fund Reserve Accounts and spend Reserve money without having to constantly move cash into and out of the Reserve Investment Account. Any time that the Association’s Balance sheet shows money due to/from the Reserve Account, there is commingling of funds. This Asset/Liability entry is prevalent in most of Jupiter Bay’s monthly financial report. Also, Jupiter Bay has always commingled the Operating Funds of its 8 associations.

Cash Balance versus Fund Balance

In condominium association financial accounting, there is oftentimes confusion between the terms Cash Balance and Fund Balance. As a not-for-profit corporation, the Association uses Fund Accounting, which emphasizes how money is spent rather than profitability, and it requires that operating and replacement funds (reserves) be classified separately. Also, Accrual Accounting is used, rather than Cash Basis, for tracking and recording income and expenses. This means that income exists when owner invoices are generated, and expenses exist when vendor bills are entered into the Association’s accounting software.

Cash Balance is a point-in-time value based primarily on:

- Cash-on hand (e.g., petty cash)

- + Receivables (money invoiced and not yet received)

- - Payables (bills received but not yet paid)

Because of separate accounting for operating funds and reserves, a “due to/due from” account is included showing money owed to the Operating Account from the Reserve Account.

Cash Balance is a lot like an individual’s checking account, where the daily balance fluctuates day-by-day as income is posted and checks are written. For example, the Association’s financial reports showed a $-94,337 cash balance in December 2018 and a $229,064 cash balance in January 2019. Consequently, Cash Balance, as posted on a monthly financial report, is a rather meaningless figure for determining the financial strength of an organization. This number is more suspect for two reasons:

- Although we generally wait until the 15th of the following month to produce the financial report for the prior month end, new transactions frequently trickle in past the cutoff date, and

- The December monthly financial report does not reflect the auditor’s yearend adjusting journal entries.

On the other hand, Fund Balance is a very precise audited number. It can be calculated for the current year’s Operating Fund as Revenues minus Expenses. According to the Auditor’s Report, this figure for the year ending December 31, 2018 is $-1,110. Counting all prior years, the Association’s fund balance was $-74,855, the number that I report. From a balance sheet perspective, this same number results from the calculation of total Assets minus total Liabilities.

Accountants caution that Cash Balance is different than Fund Balance. They say that “Cash is a current liquid asset while Fund is a liability which may be current or non-current and doesn’t have to be liquid.” However, the association’s accurate financial position comes from the Fund Balance line of the Auditor’s Annual Report and not from any point-in-time available cash figure from an imprecise monthly financial report. Fund Balance reflects the Association’s true net financial position, which provides an accurate Cash Balance. Fund Balance tells how much money is being borrowed from future assessments.

Distribution of Surplus Funds

Several homeowners have asked about what happens at yearend if the assessment monies collected from them exceed the Association's expenses. They want to know if the money should be returned to them, and if not, where does it go?

The answer to the question depends on whether this is a surplus from regular quarterly owner assessments or a surplus from special assessments. Here’s the answer to both:

Regular Quarterly Assessment Surplus

Florida Statute 617.0505 says “Except as authorized in s. 617.1302 (dissolution), a corporation may not make distributions to its members, directors, or officers.” This means that a common surplus of funds resulting from income exceeding expenses cannot be returned directly to the unit owners and an alternative disposition must be used. The alternate disposition of excess funds can be:

- Credited towards the next year’s budget for the benefit of unit owners in the same percentage as their ownership in the common elements (this is most common), or

- Allocated to the reserve accounts of the association.

Paragraph 9.1(a) of Jupiter Bay’s bylaws says “Current Expense, which shall include all receipts and expenditures within the year for which the Class A and Class B Budgets are made including a reasonable allowance for contingencies and working funds, except expenditures chargeable to reserves, to additional improvements or to operations. The balance in this fund at the end of each year shall be applied to reduce the assessments for Class A and Class B expenses for the succeeding year."

Special Assessment Surplus

Special Assessment are treated differently in that they can either be returned to the unit owners or applied as a credit toward future assessments.

This is clarified in Florida Statute 718.116(10), which says “The specific purpose or purposes of any special assessment, including any contingent special assessment levied in conjunction with the purchase of an insurance policy authorized by s. 718.111(11), approved in accordance with the condominium documents shall be set forth in a written notice of such assessment sent or delivered to each unit owner. The funds collected pursuant to a special assessment shall be used only for the specific purpose or purposes set forth in such notice. However, upon completion of such specific purpose or purposes, any excess funds will be considered common surplus, and may, at the discretion of the board, either be returned to the unit owners or applied as a credit toward future assessments.”

Jupiter Bay's Financial Management requires understanding Florida statutes and administrative codes and general accounting principles.

Jupiter Bay's Financial Management requires understanding Florida statutes and administrative codes and general accounting principles.